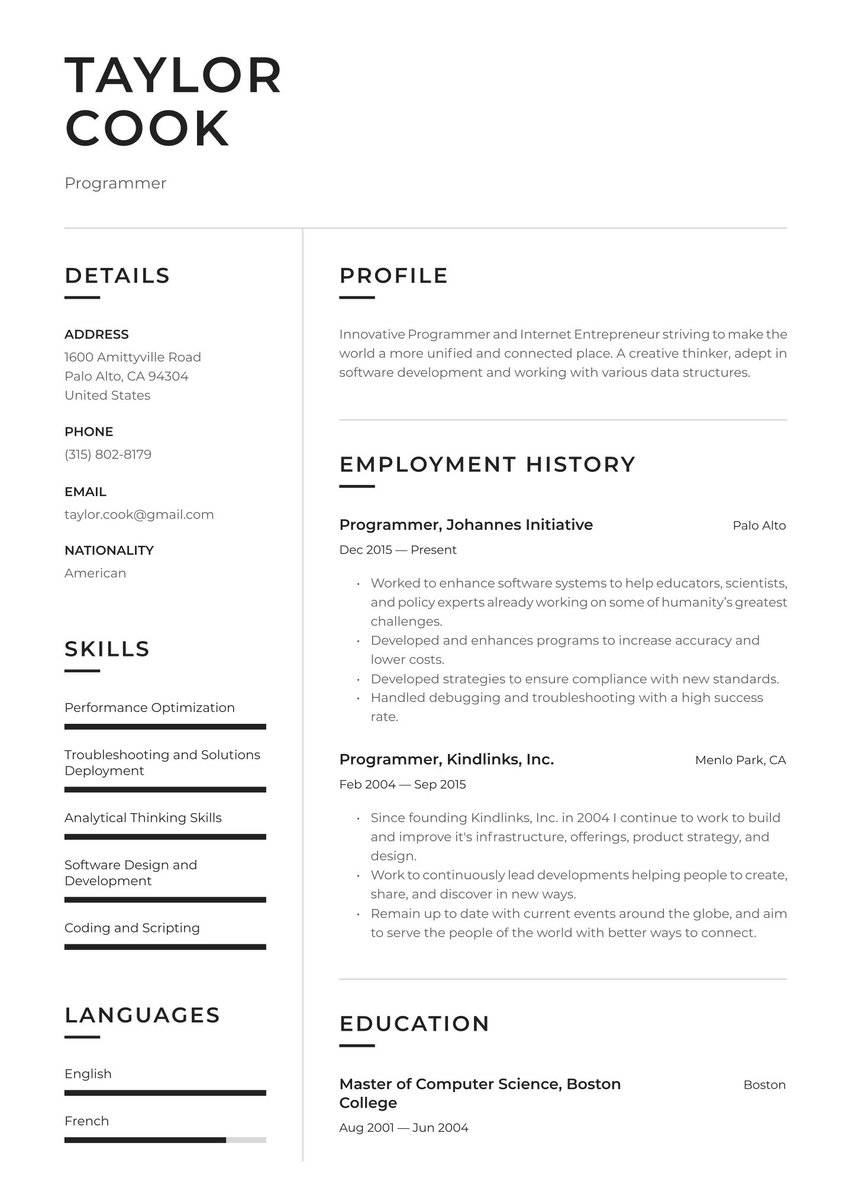

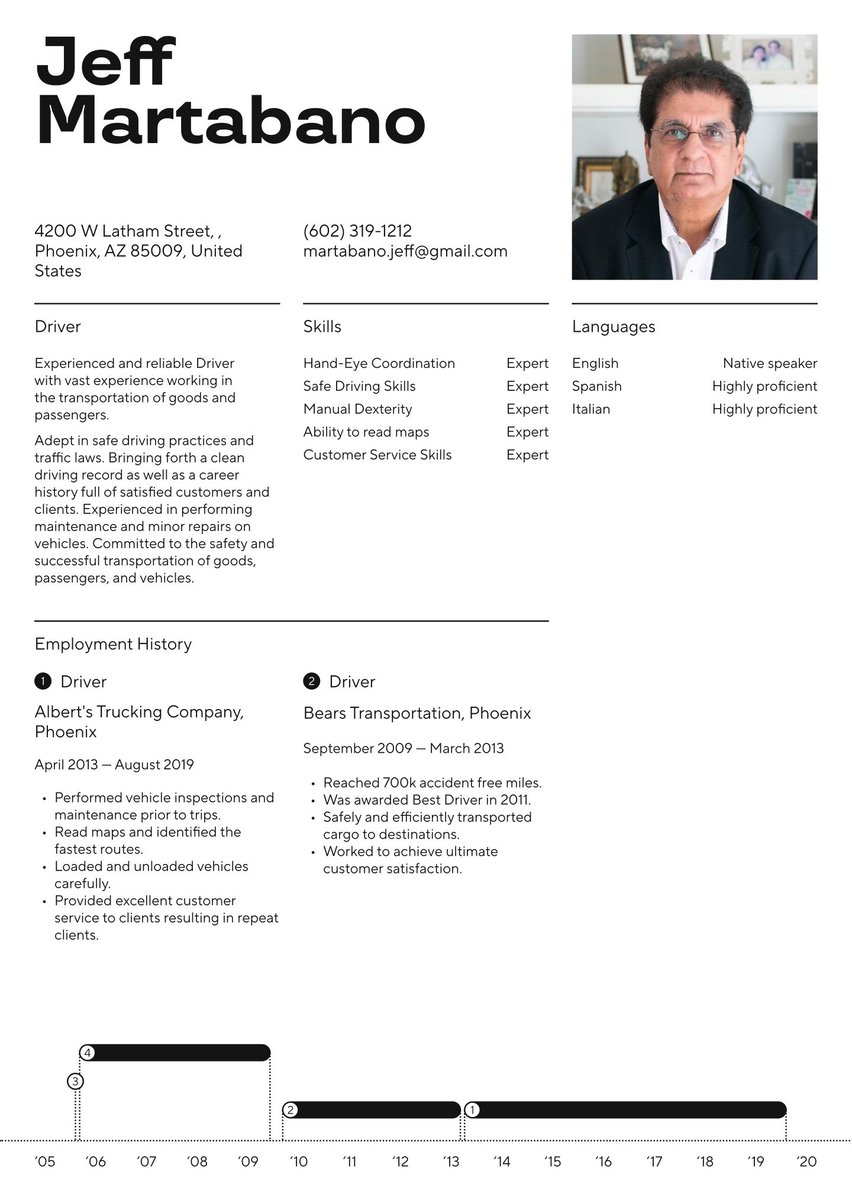

Ambitious and analytical finance professional with an MBA and 5+ years of experience in investment banking seeking a private equity associate position at Blackstone to contribute to the firm's investment strategies, perform due diligence, and drive value creation for portfolio companies.

07/2020 - present, Investment Banking Associate, Goldman Sachs, New York City

- Conduct financial analysis and modeling for M&A transactions and capital markets offerings in the technology and healthcare sectors

- Perform due diligence on potential acquisition targets and assess strategic fit and valuation

- Prepare marketing materials and presentations for client pitches and deal execution

06/2015 - 06/2018, Investment Banking Analyst, Morgan Stanley, New York City

- Supported senior bankers in the execution of M&A transactions, leveraged buyouts, and equity and debt offerings

- Developed financial models to analyze company performance, valuation, and pro forma capitalization

- Conducted industry research and prepared market update presentations for internal and external stakeholders

08/2018 - 05/2020, Master of Business Administration (MBA), Stern School of Business, New York City

- GPA: 3.8/4.0

08/2011 - 05/2015, Bachelor of Science in Economics, The Wharton School, Philadelphia

- GPA: 3.7/4.0

- Financial modeling and valuation

- Due diligence and transaction execution

- Industry research and analysis

- Presentation and communication

- Leadership and teamwork

A private equity resume is like a great lead on a promising company needing a cash infusion. When the opportunity arises, you do your due diligence, and then you act quickly. A compelling resume does the same for your job search. It gets the hiring manager to act on your application. Make your job search profitable with a resume that gets you that interview in no time.

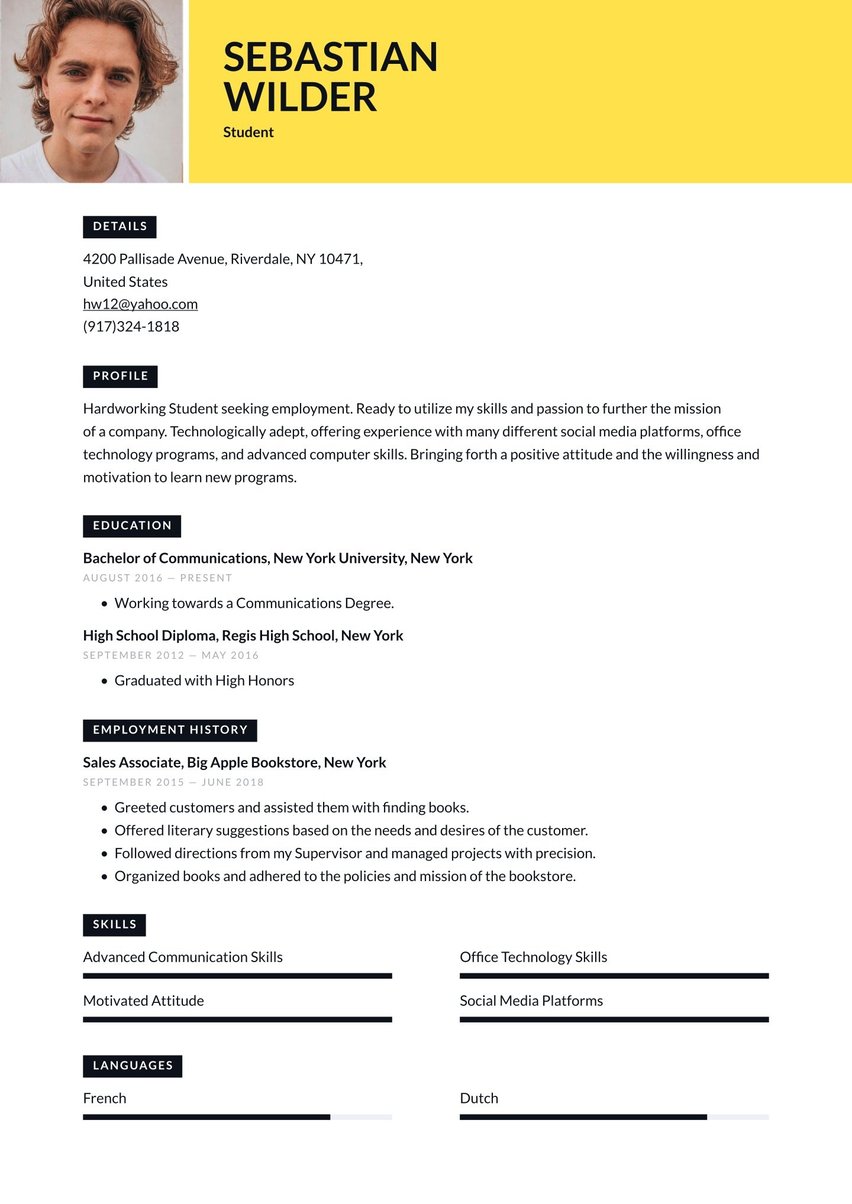

Private Equity resume examples by experience level

How can a resume do that for you? By employing passion and a clear message.

As a businessperson with an eye for a good deal, you know that you need to present your case strongly and with ample evidence to convince the board they should invest. You may only have one shot at it, so your first impression has to be a great one. Your private equity resume performs the same task for the firm’s HR department. An energetic resume will make a great first impression and encourage them to invest in your future.

Resume guide for a private equity resume

Propel your job hunt with Resume.io and our expert resources including guides and resume examples for over 500 professions. Our resume builder steers you through the creation of a resume that will resonate with employers.

This resume guide and the embedded private resume example will cover the following:

- How to write a private equity resume

- Choosing the right resume format for private equity

- How to add your contact information

- Developing impressive summaries

- Adding your private equity experience

- Listing education and relevant experience

- Picking the right resume design/layout

- What the private equity market looks like and what salary you can expect

How to write a private equity resume

Before you dive in, you need to know what sections you’ll be writing for your private equity resume. Your resume should contain the following elements:

- The resume header

- The resume summary (aka profile or personal statement)

- The employment history section

- The resume skills section

- The education section

While all resumes contain common elements, you know that just like with companies in the same industry, no two are alike. Details matter and your job is to ferret them out. Convincing the hiring manager to give you a shot requires knowledge of what they want and how to present it, just as you do when you argue for investment in a new company. Do some digging into the firm’s culture, the types of companies it typically invests in, and how it operates. Then, tell them why your talents and skills fit the bill.

Any good presentation has a structure. Stick to this structure for your private equity resume:

- Showcase achievements, not job responsibilities. What will you bring to the firm that others won’t? Demonstrate this with the highlights of your career so far and what your successes have brought to your employers.

- Refocus your resume to speak directly to each employer. Match the tone and style of the firm. Adjust your bullet points and skills to tell them that you know exactly what they need and that you can provide it.

- Pay as much attention to the layout and design as to your text. Present yourself as professional and analytical without coming off as boring or rigid.

- Target the ATS filtering software with appropriate keywords for every online application. ATS resume templates are designed to smooth that process.

Optimize for the ATS

Before a human being lays eyes on your carefully crafted private equity resume, it must pass the Applicant Tracking System test. ATS software is programmed with algorithms that rank resumes according to keywords and other data important to the employer. You can boost your chances of making it through this gatekeeper using your analytical skills to choose appropriate keywords.

For example, if the private equity job description seeks:

- “Private equity associate”

- “Two years of experience”

- “Ability to analyze data to provide insights and directions to clients”

- “Proficiency in negotiating fund documentation”

An ATS-optimized summary could say:

“Private equity associate with two years of experience analyzing data and providing insights and direct to clients. Proficient in negotiating fund documentation. Tailored investment strategies for client produced 15% increase in realized gains over one year.”

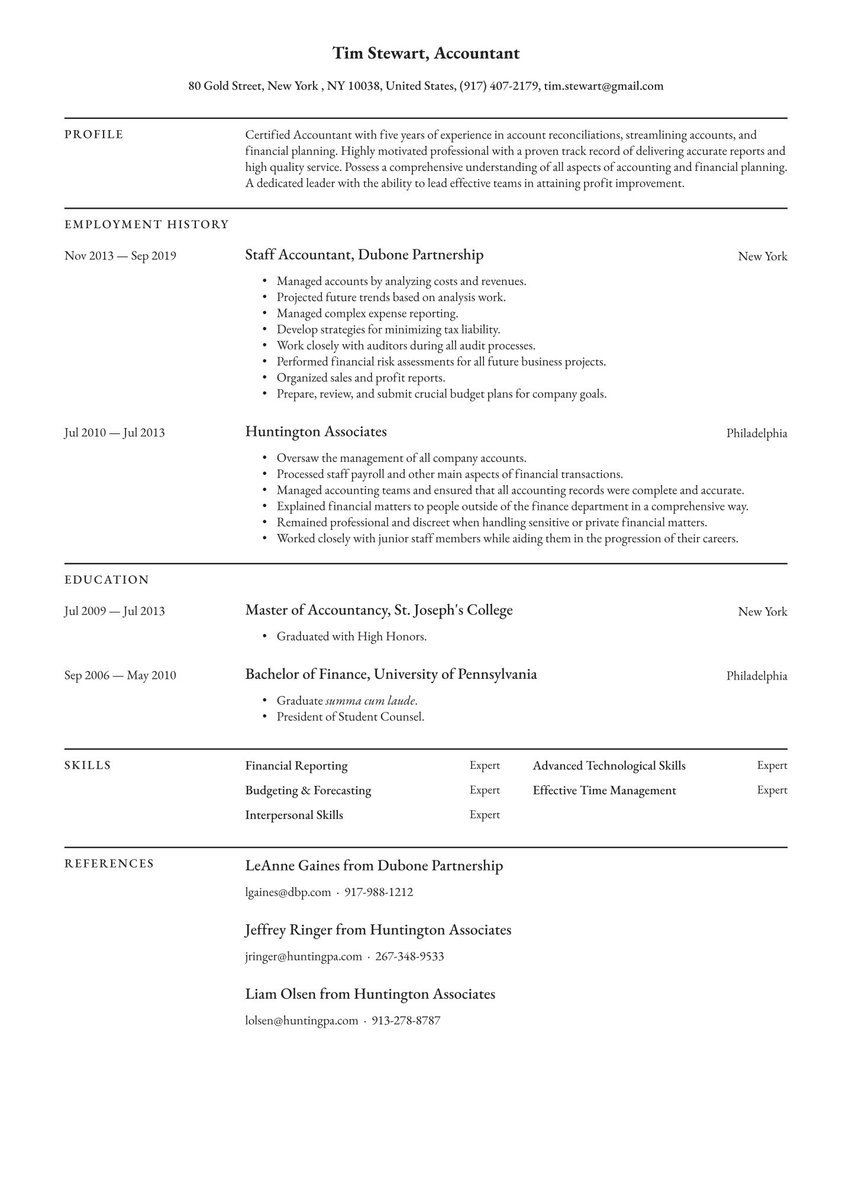

Choosing the right resume format for private equity

Your resume needs to project professionalism, attention to detail, and communication skills; the same image you want to project during your interview.

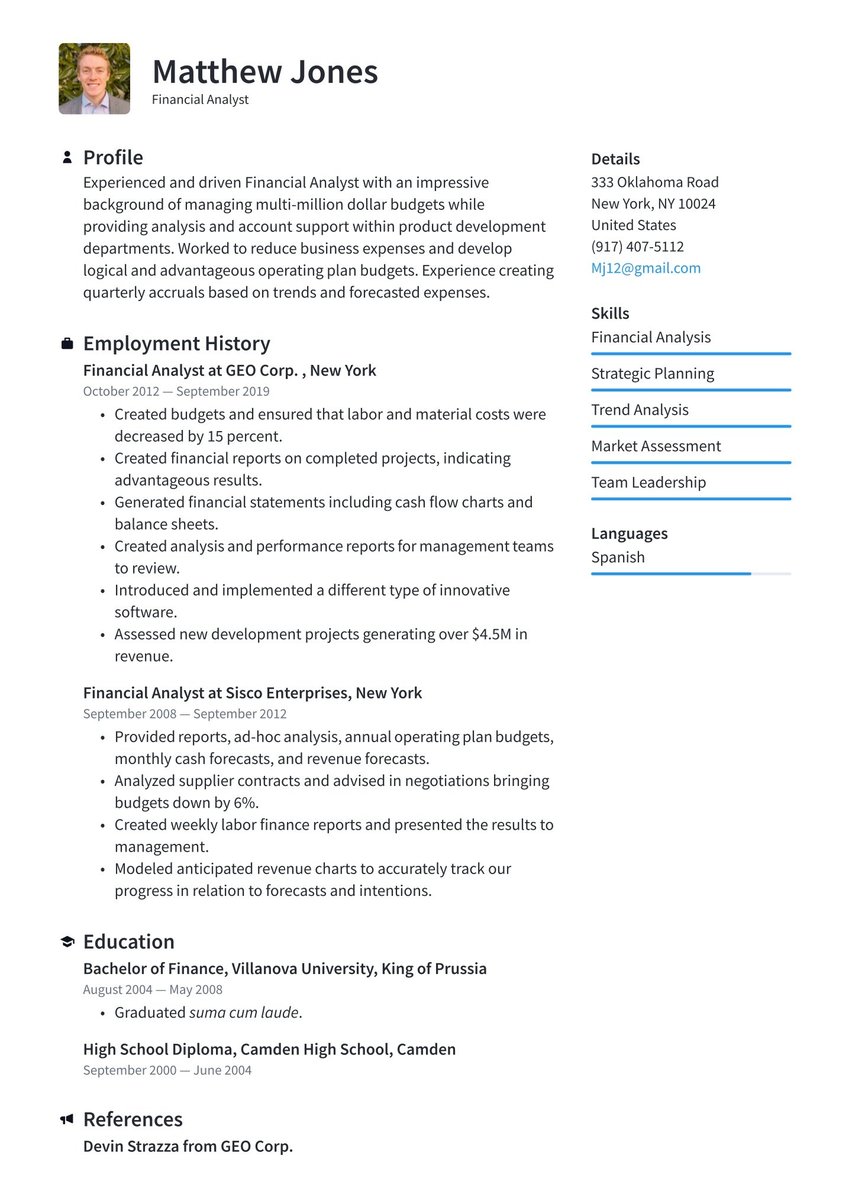

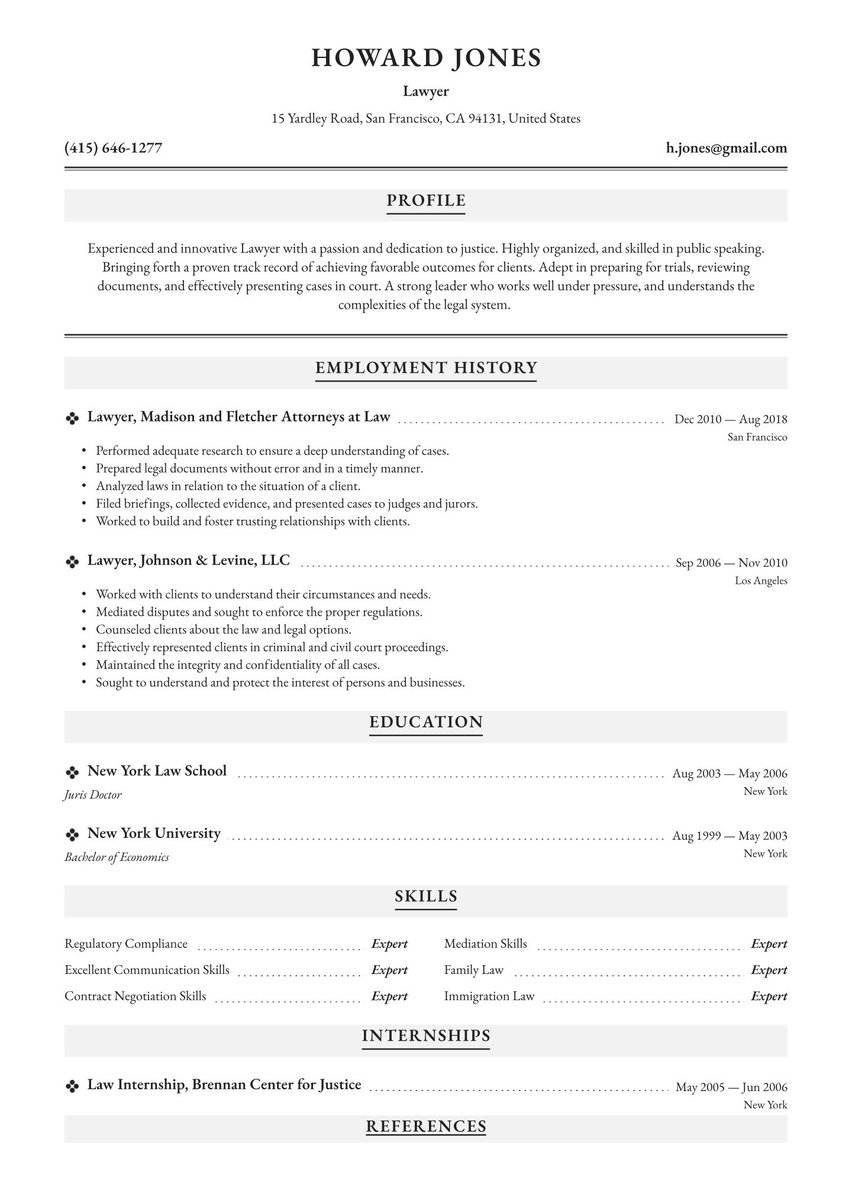

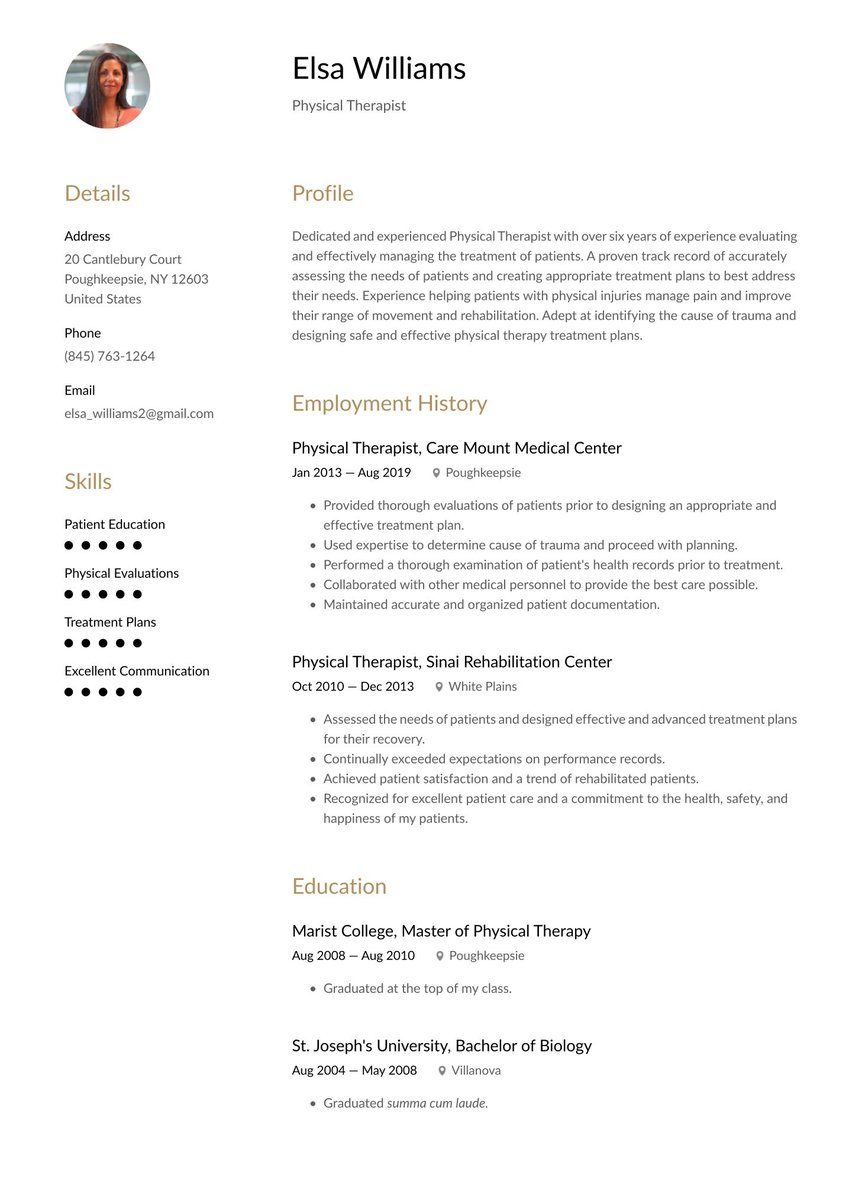

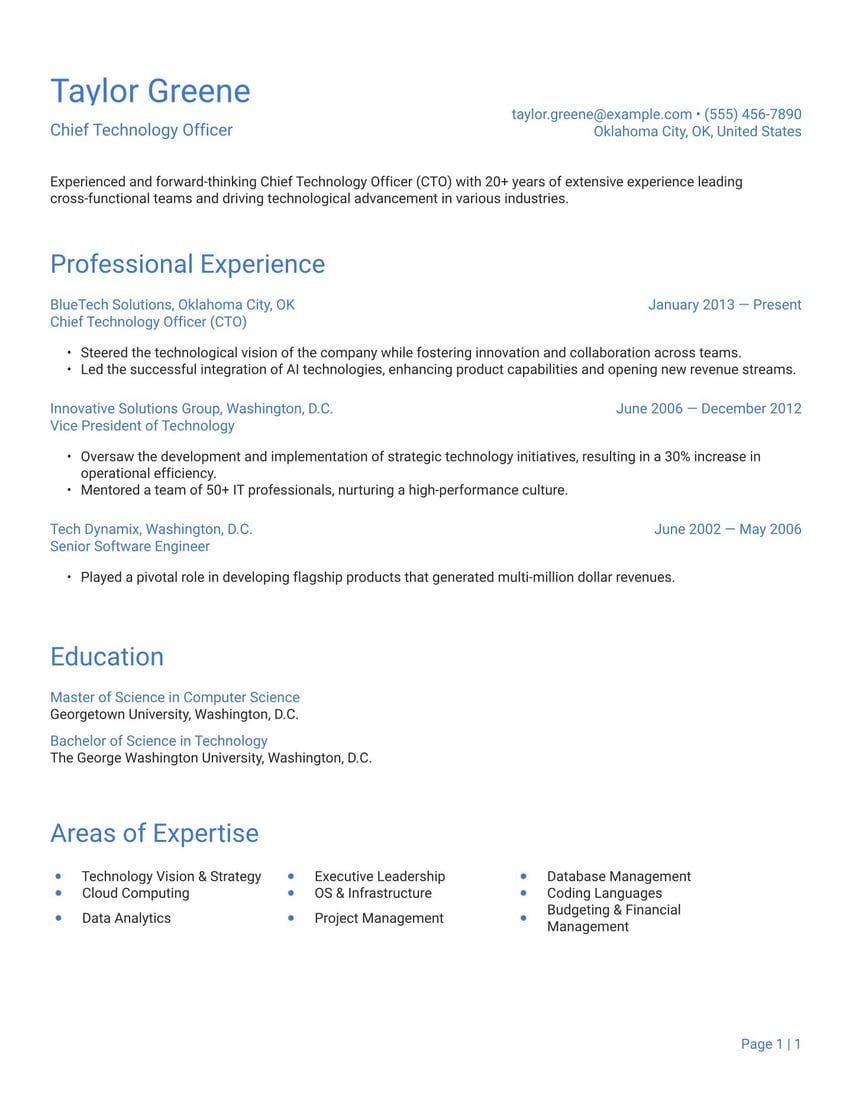

The best format for most private equity resumes is the reverse chronological, which is also the most common. It’s common because it presents the best opportunity to outline the story of your career success and because recruiters can scan it easily. Your employment history, listed in reverse chronological order, takes up the bulk of the space in this one-page document. Below is an example of this format.

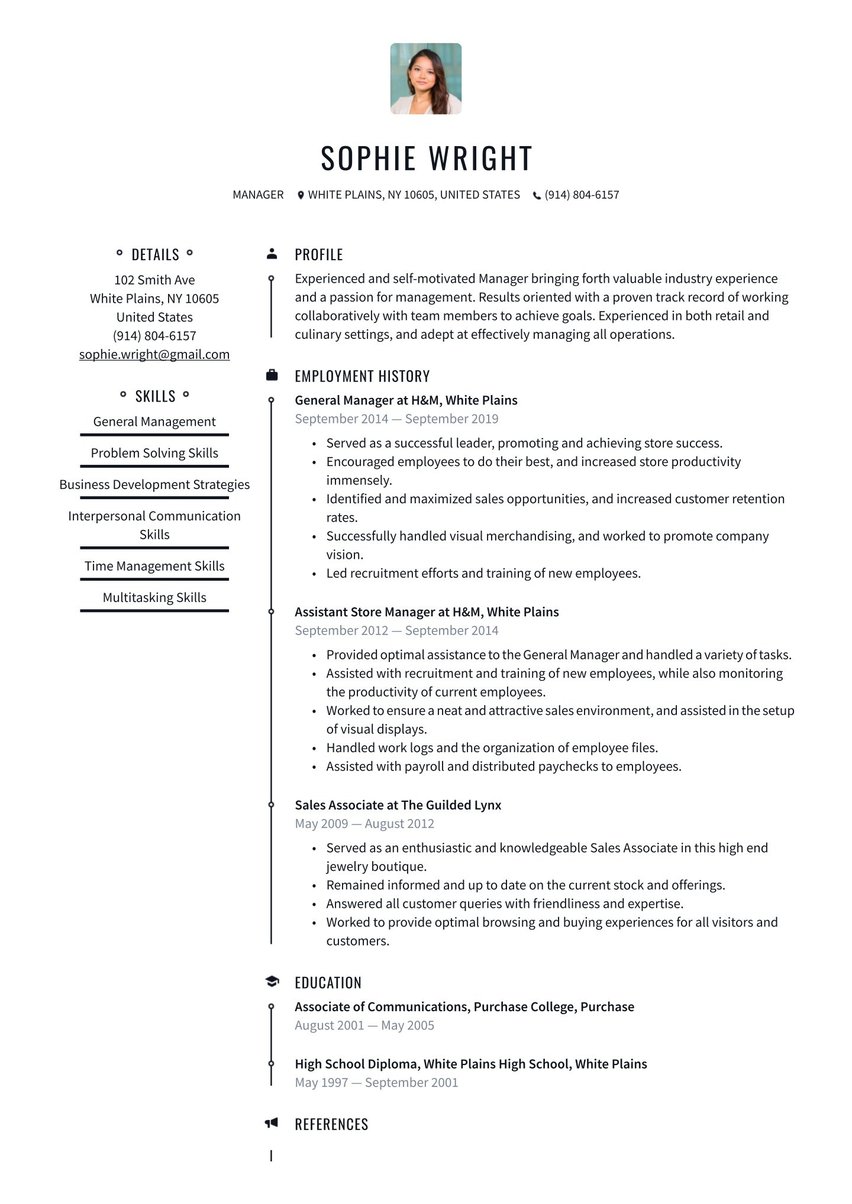

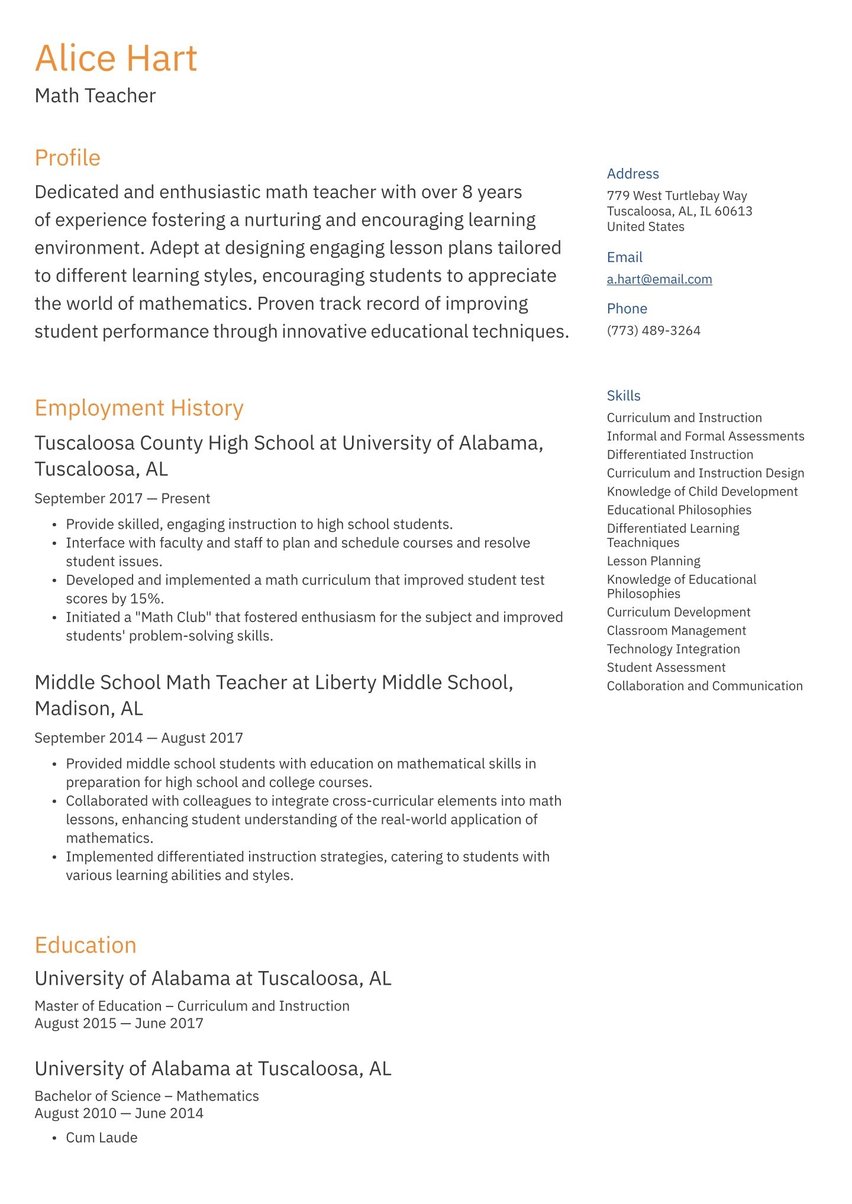

Job hunters beginning their private equity career or seasoned pros with years of experience under their belts may do better with the functional format, which puts the focus on skills over work history. A hybrid style combines the two.

When you’re ready to choose from among the many resume templates in our resume builder, you can also choose the format that works best for your career story. We have layouts for all three formats available as resume examples.

Include your contact information

Your clients and prospective clients know how to reach you because they have a hard copy or virtual version of your business card. The header of your private equity resume serves the same purpose.

List all your contact information professionally. HIghlight it so it's easy to find and read.

- Full name and title. List your first and last name. If you have a common name, consider adding your middle initial. Use the extract title from the job ad.

- Professional email address. Use a clean format like [email protected].

- Phone number. List a number where you can be readily contacted, with a professional voicemail greeting.

- Location. Include only your city and state. Listing a street address or zip code is outdated and reveals more information than necessary. Note 'Willing to Relocate' here if applicable.

- LinkedIn. If your LinkedIn profile is up-to-date and shows your finance or industry network, include it here.

Don’t include:

- Date of birth: Not necessary and could potentially lead to age discrimination.

- Personal details: Marital status, social security number, passport number, etc.

Jane L. Walters

Private Equity Analyst

(718) 403-0958

Brooklyn, NY

www.linkedin.com/jlwaters-PE

Craft a summary that excels

How do you approach a new client? You probably begin with a well-considered introduction designed to open the door to a profitable relationship. You want them to trust you and understand that you have the same goal: increased growth and earnings.

The summary is the opening statement of your private equity resume. Tell the employer that you’re just the person to improve the bottom line with great investment strategies and client relationships. These 2-3 sentences put a laser focus on your career expertise and value.

Write with confidence, using strong verbs such as networked, negotiated, analyzed, invested followed by the details of what your actions achieved.

The sentence: “Private equity analyst with track record of identifying profitable opportunities and negotiating favorable contracts with clients” gives employers an immediate understanding of who you are as an analyst. It goes beyond repeating information from your work history and instead acts as an all-embracing description of your career.

The summary is your best opportunity to carve out how you want to be seen in your new job. Are you primarily a data cruncher who presents analysis to the board? A client-facing associate who loves negotiating? An all-around finance expert? Emphasize the unique value you will bring to the employer.

Need inspiration for your summary? Check out our related finance resumes:

You can find adaptable private equity resume examples summary below:

Recent finance graduate with keen eye for value and strong foundation in data analysis and market research. Exceptional attention to detail, excellent quantitative abilities, and a passion for uncovering investment opportunities. Ability to thrive in a fast-paced environment and eager to apply academic knowledge to your esteemed private equity firm.

Private equity analyst with four years of experience executing complex transactions and driving the value of client companies. Skilled in managing relationships with stakeholders, and negotiating deals in various industry sectors. Identified deals that brought in $1.3M, while providing investment guidance to clients.

Private equity managing director with extensive experience putting together high-profile and lucrative transactions throughout the investment lifecycle. Adept at sourcing, executing, and managing deals across diverse industries that enhanced the bottom line by more than $10M a year. Expertise in guiding investment strategies, optimizing portfolio performance, and fostering long-term investor relationships.

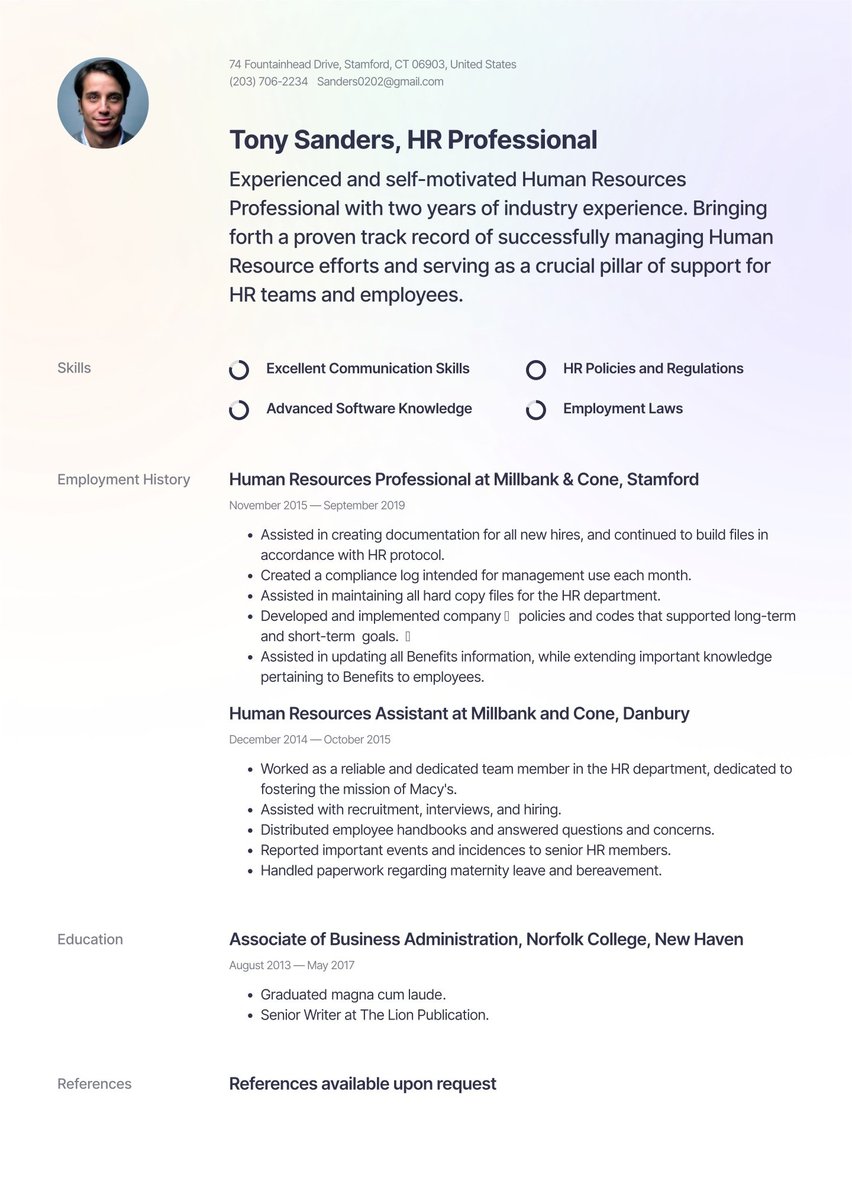

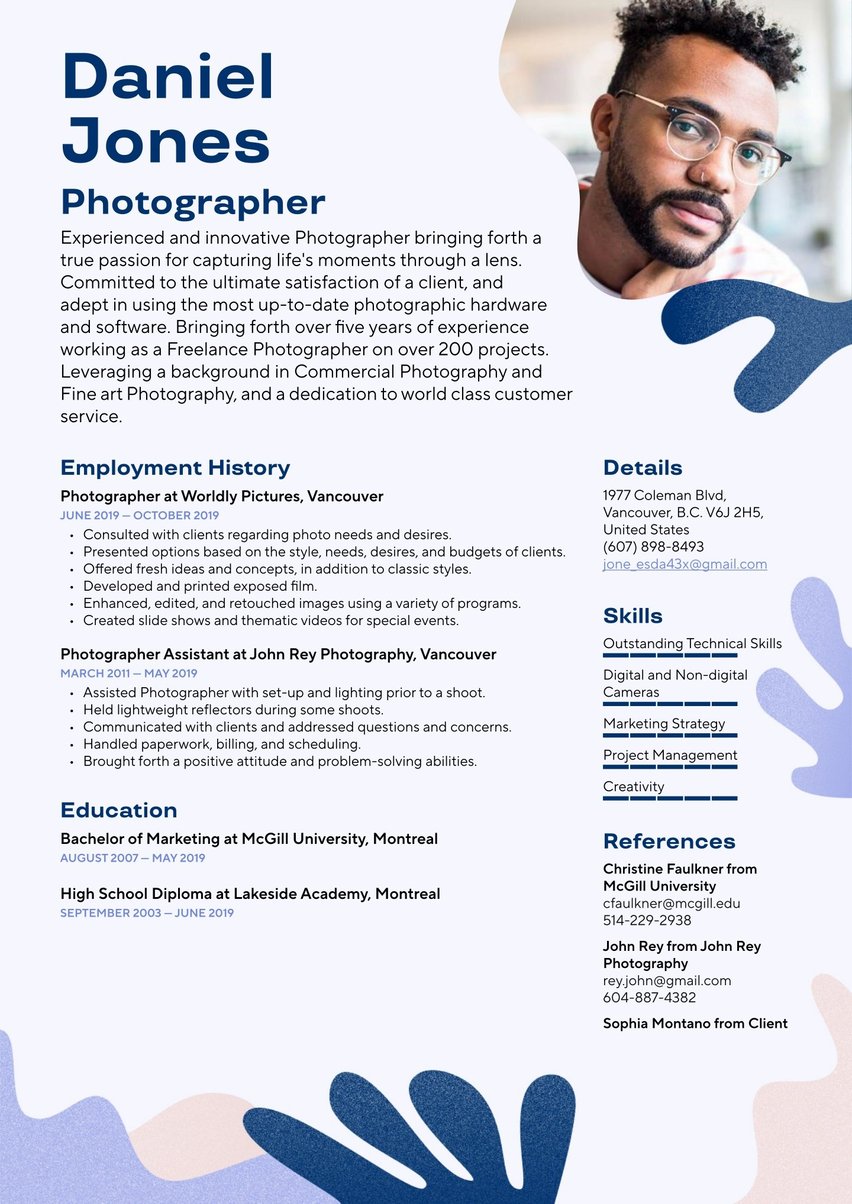

Outline your private equity work experience: your career valuation

The employment history section of your private equity resume provides the data and details that back up with assertions you made in your summary. Beginning with your current or most recent position, list all your private equity and related work experience for the past 10-15 years.

Use the most space on your current job since it demonstrates the skill level you have achieved during your career. Start each item with an action: cultivated, executed, managed, maximized, optimized. Then quantify the results of your actions with specific dollar amounts or other relevant data that hones in on your value to the firm.

Job descriptions such as the one below do not provide enough detail:

- “Performed analysis of financial data.”

- “Identified potential investments.”

- “Structured complex deals.”

These items are a good start, but are rather generic. Are there private equity associates who aren’t responsible for these basic tasks? What makes how you completed these tasks special? What professional competencies are you trying to portray?

Punch up these phrases by including the details of how you accomplished them and your excellent results. These are the differentiating facts that tell the employer why they should bring you in for an interview.

Here are examples of the bullet points above, rewritten in a more compelling format:

- “Analyzed portfolio data to identify inefficiencies and cost-saving opportunities, leading to savings of $750,000 a year.”

- “Sourced and evaluated investment opportunities across diverse sectors, resulting in returns of 25% annually for investors.”

- “Structured complex deals, including all negotiating and documentation, to the satisfaction of all stakeholders.”

Take a look at the private equity employment history resume sample below:

Investment Banking Associate at Goldman Sachs, New York City

July 2020 - Present

- Conduct financial analysis and modeling for M&A transactions and capital markets offerings in the technology and healthcare sectors

- Perform due diligence on potential acquisition targets and assess strategic fit and valuation

- Prepare marketing materials and presentations for client pitches and deal execution

Investment Banking Analyst at Morgan Stanley, New York City

June 2015 - June 2018

- Supported senior bankers in the execution of M&A transactions, leveraged buyouts, and equity and debt offerings

- Developed financial models to analyze company performance, valuation, and pro forma capitalization

- Conducted industry research and prepared market update presentations for internal and external stakeholders

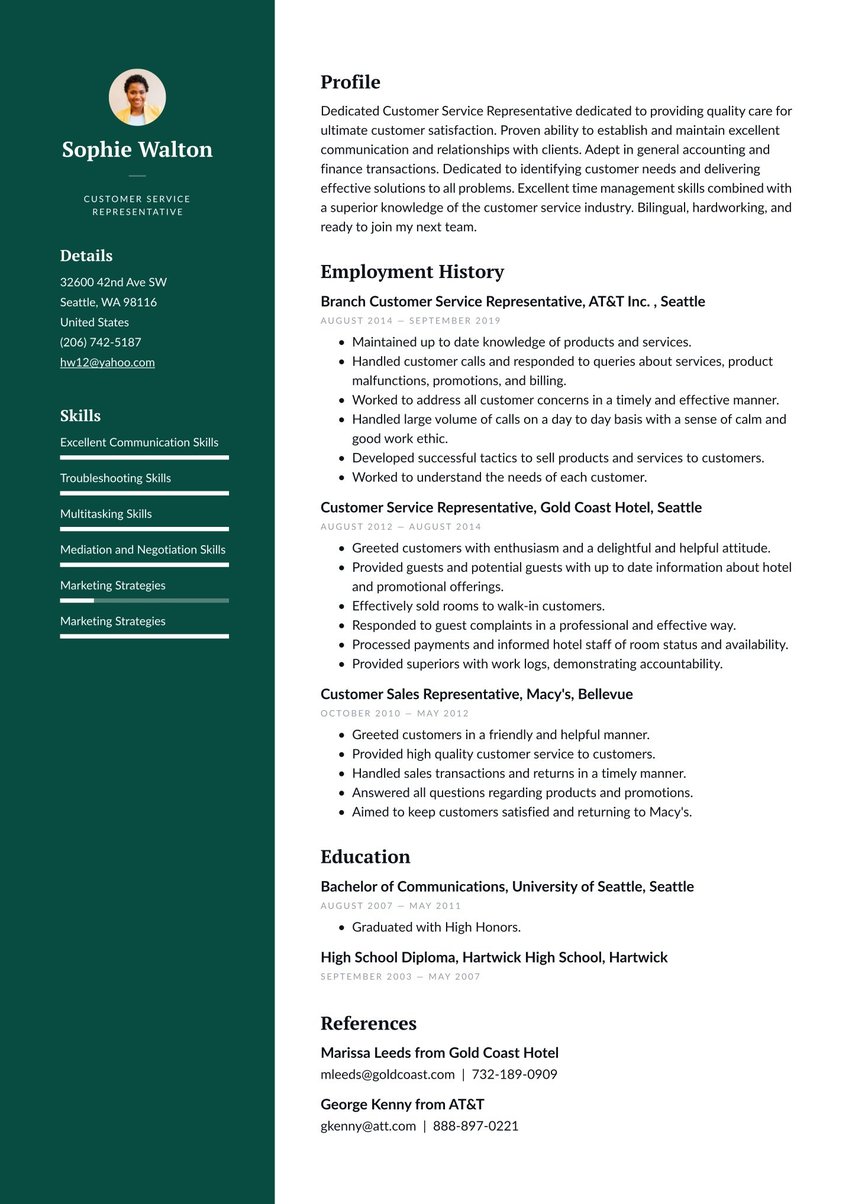

How to write a private equity resume with no experience

A private equity resume with no experience focuses on your academic foundation in finance, any internships you have completed, and the transferable skills you have demonstrated in unrelated positions.

Client-facing private equity associates need a host of interpersonal skills. They are also detail-focused and strategic thinkers. If you have had any part-time or summer jobs such as server in a restaurant or cashier at a supermarket, you have demonstrated customer service and excellent communication skills.

You may also use your academic projects as examples to demonstrate skills such as data analysis and understanding of financial strategies.

Include internships within your work history section if you performed tasks directly related to private equity. All other positions should be listed as “Other experience.”

While you haven’t begun your working life, these components show you have been working toward your goal of a career in private equity even with no direct experience on your resume.

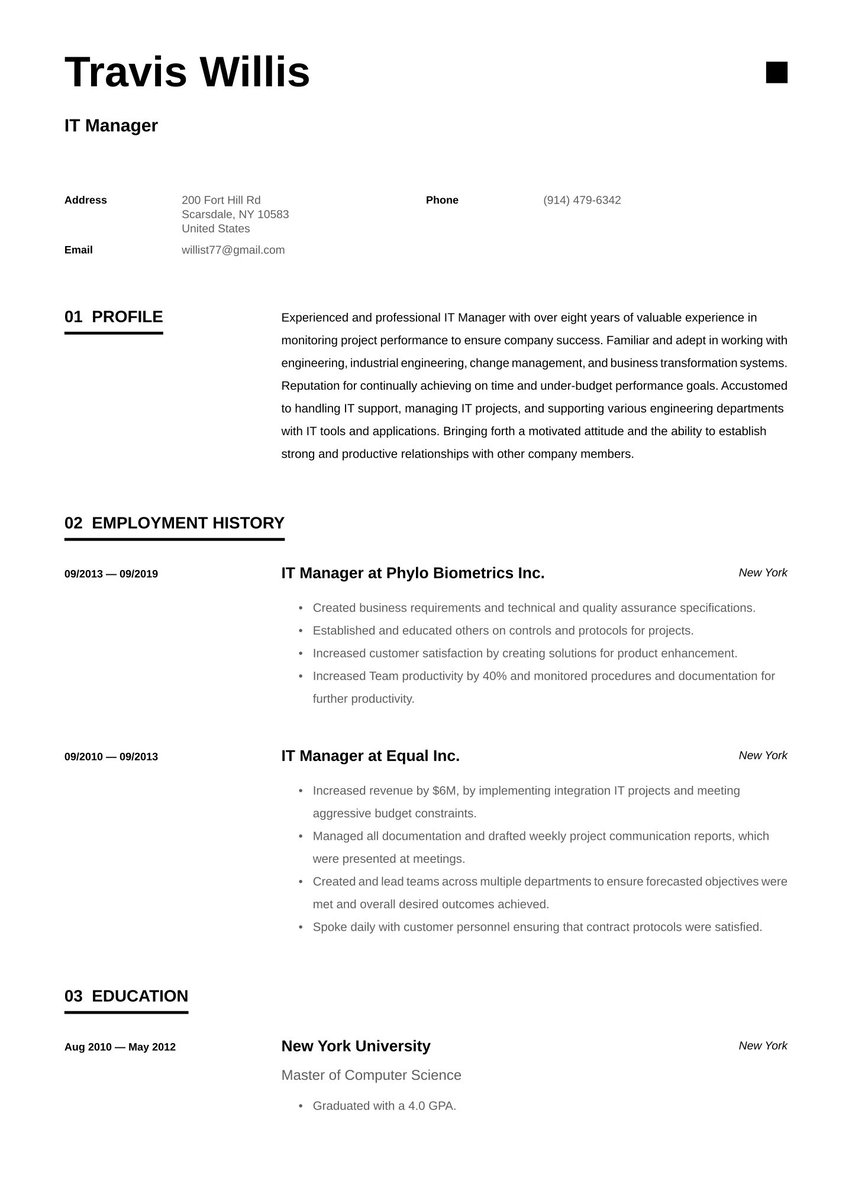

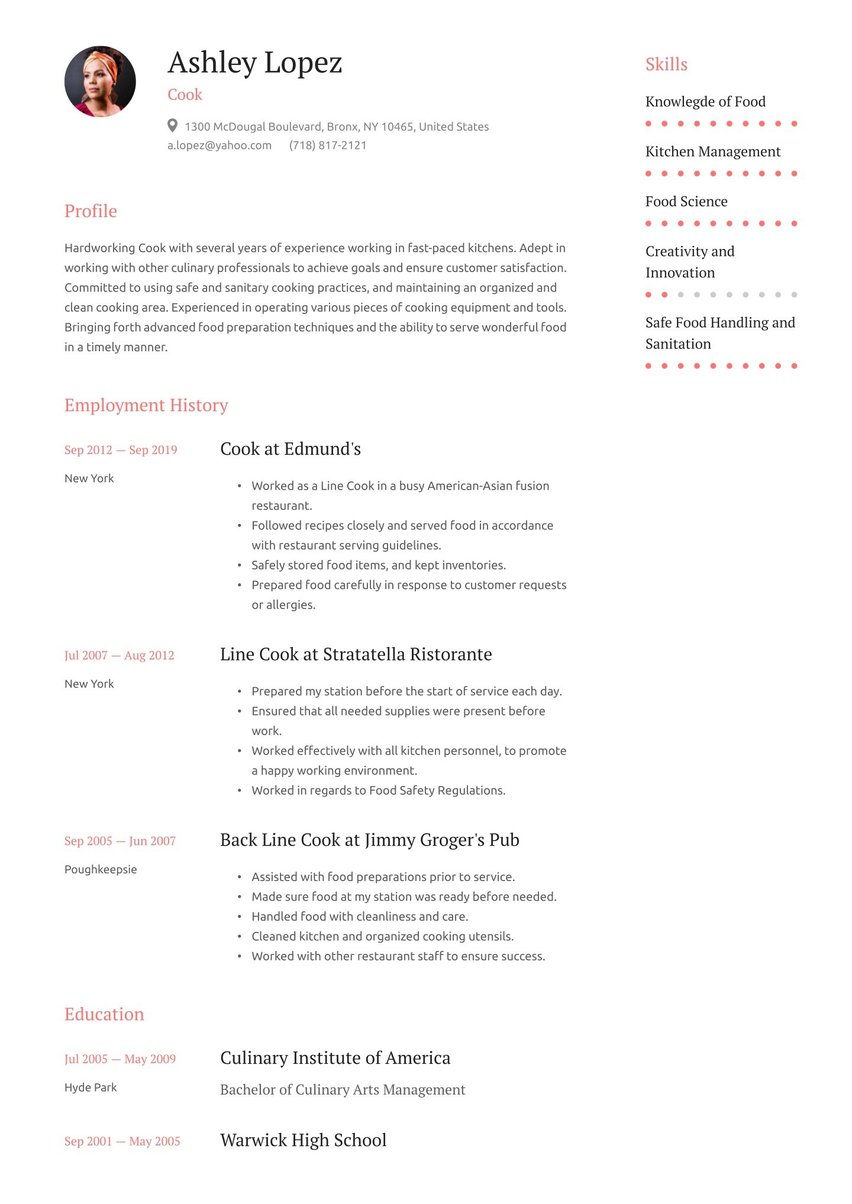

Include the relevant key skills that make you great at private equity

Your skills list is a different form of career summary. Within it, choose the hard and soft skills that present the full picture of what you bring to your private equity work. Recruiters scan this list to get a quick overview. If you don’t have what they’re looking for, they may go no further.

Including hard skills such as financial analysis, valuation, and modeling is obvious, but don’t overlook risk management, due diligence, or deep knowledge of the industry in which you operate.

While those learned skills are necessary, soft skills could make all the difference. Strategic planning, analytical thinking, negotiation, and investment advising all enhance your candidacy.

When using the resume builder, you may choose from a preloaded list of skills and proficiency levels or add your own.

Here’s what the skills box looks like in our private equity resume template.

- Financial modeling and valuation

- Due diligence and transaction execution

- Industry research and analysis

- Presentation and communication

- Leadership and teamwork

This section provides the skeleton of your abilities, but you need to flesh them out throughout your private equity resume. Demonstrate how you use your skills and the results you achieved in each section.

For example, use your work history and summary sections to illustrate your

- Networking by including an item in your employment history about gaining a client through a professional conference

- Financial analysis by breaking down the metrics you look at when making recommendations to the board

- Industry expertise by naming the industries in which you work and specifying a success in that industry

Analyze the job description to understand which of your skills to focus on as you customize your resume.

Game theory and negotiating

Private equity firms are always looking for great negotiators. Game theory is the study of how people make decisions when there are multiple stakeholders. Your knowledge and use of game theory is a helpful analytical tool for private equity professionals. If you strategize using game theory, add that soft skill to your resume.

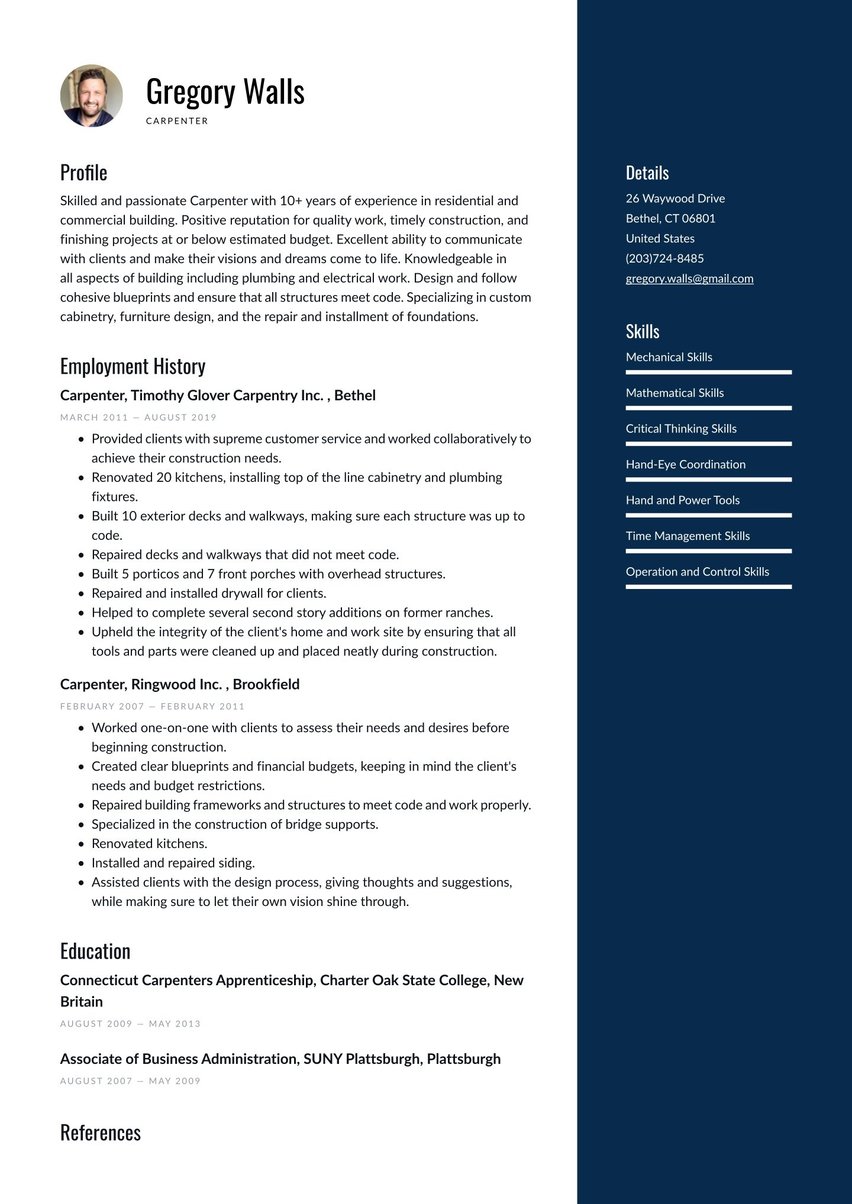

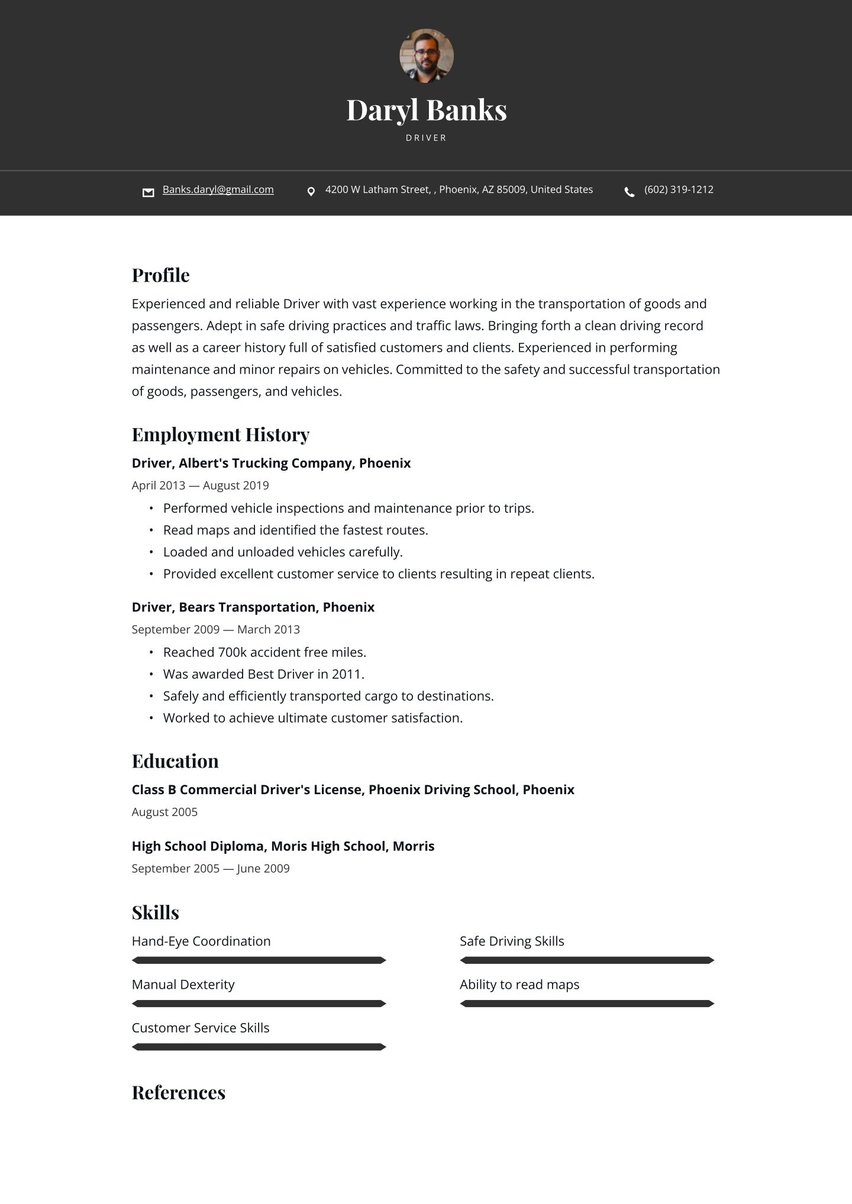

Detail your education & relevant private equity certifications

The education section of your private equity resume is a straight forward listing of your academic degrees. The bar for entry into this field is a bachelor’s degree in finance, accounting, statistics, mathematics, or economics, however, many professionals also have an MBA.

If you do have an advanced degree, there’s no need to include your high school experience.

Enhance this section with other methods of learning and professional growth you have undertaken such as:

- Training and certification. The Chartered Private Equity Professional (CPEP) certificate or any other certifications or training courses in finance or analysis add an impressive layer to your resume.

- Internships. If you are an entry-level professional, internships in the field show you have real world finance experience.

- Professional development. Detail the organizations you use to grow your network.

Master of Business Administration (MBA), Stern School of Business, New York City

August 2018 - May 2020

- GPA: 3.8/4.0

Bachelor of Science in Economics, The Wharton School, Philadelphia

August 2011 - May 2015

- GPA: 3.7/4.0

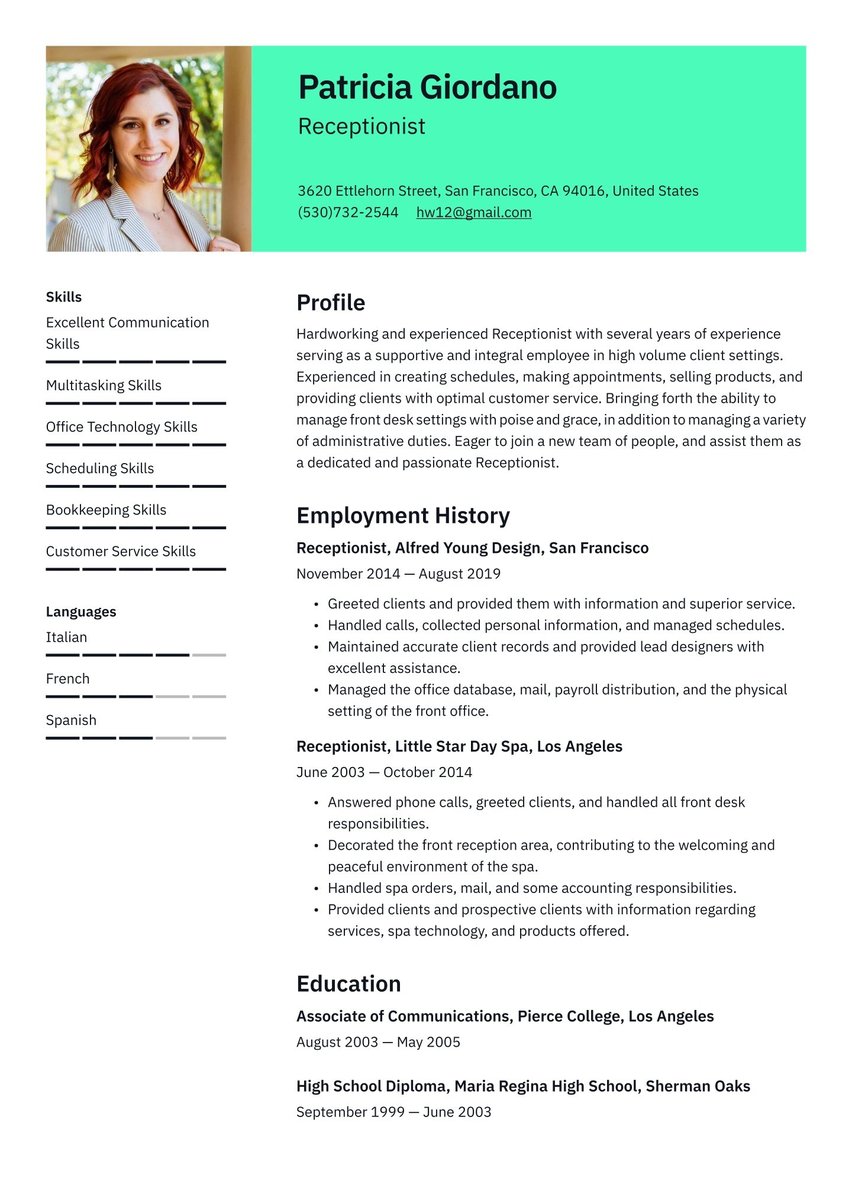

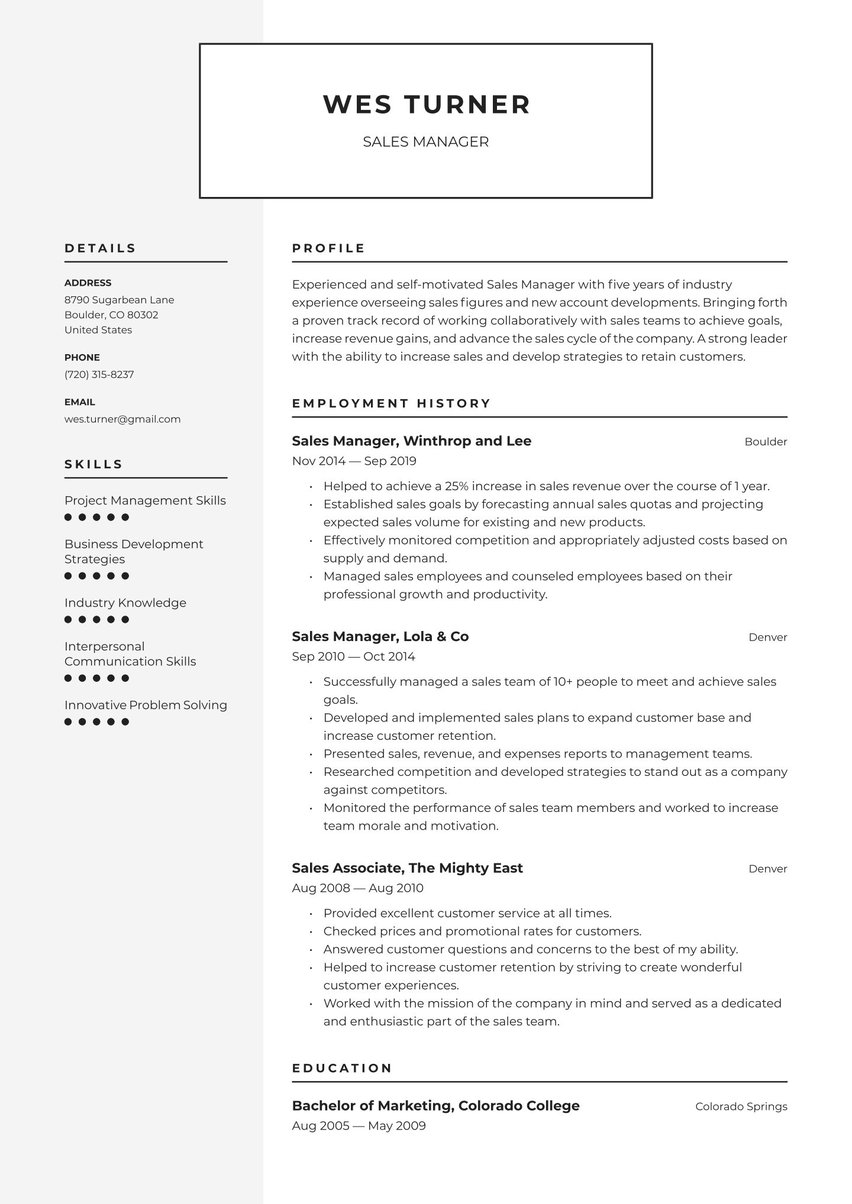

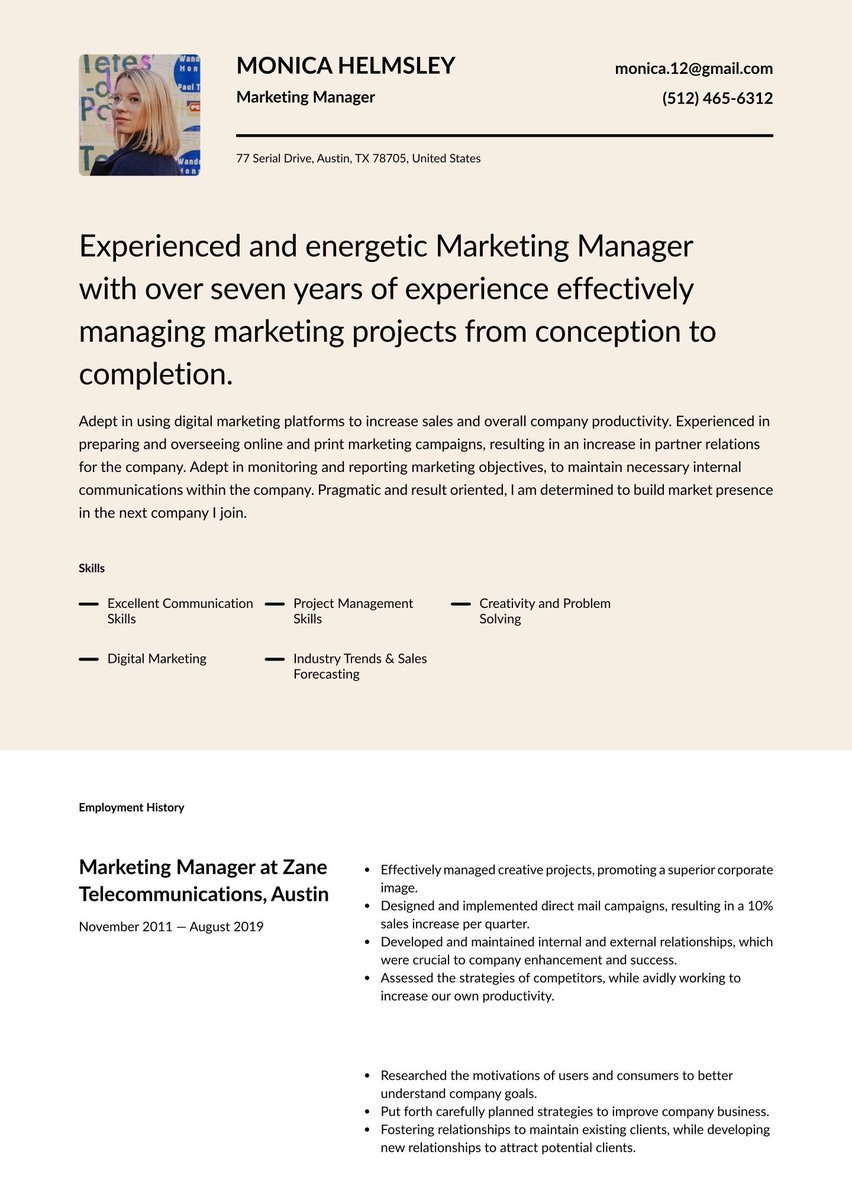

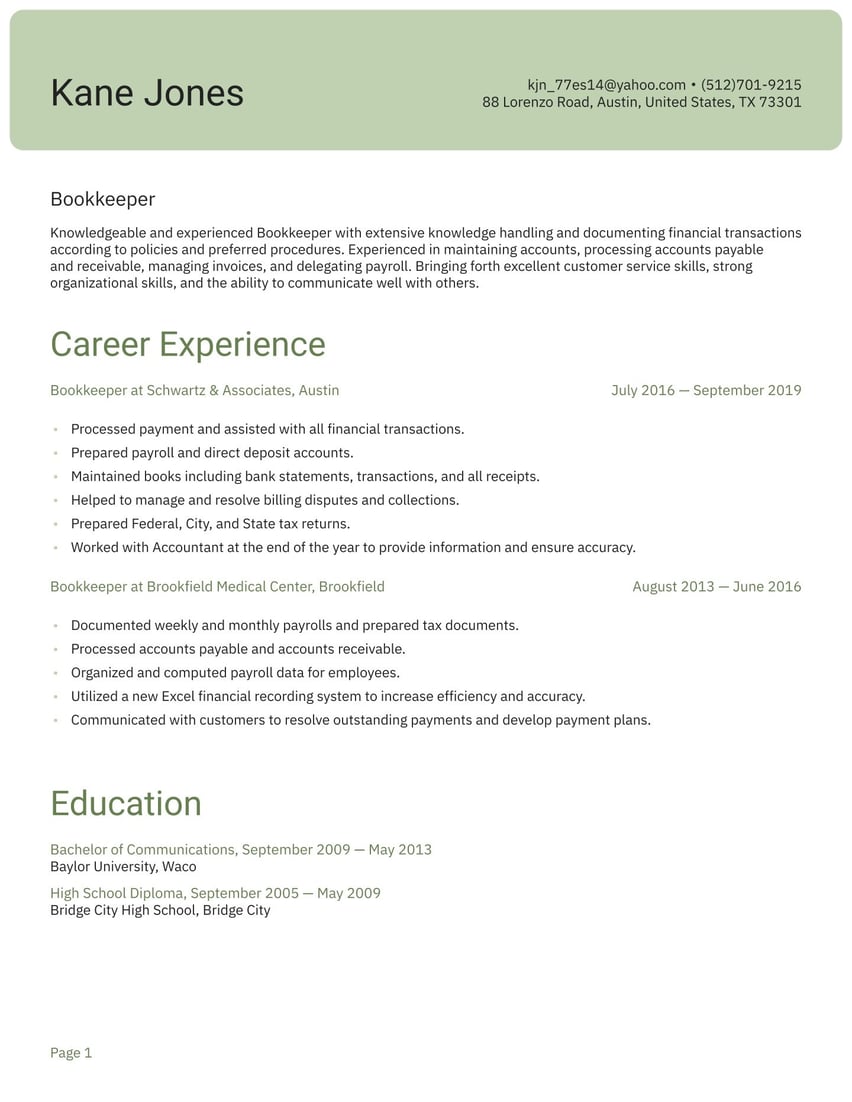

Pick the right resume layout and design for a private equity resume

When you meet a new or prospective client or attend a networking event, you pull out all the stops: formal attire is a must to make the right first impression. You want to be taken seriously as a formidable negotiator and knowledgeable financial analyst while seeming approachable.

The design of your resume announces your formidable presence in the applicant pool. The goal is for the hiring manager to see you as professional and knowledgeable, but not standoffish or inflexible. That requires a design that’s reader-friendly, professional, and clean.

Private equity can be a conservative business, so while you want to grab their attention, avoid graphics, icons, or other distracting images. Unless you know the firm is more freewheeling, leave out the color and stick with common fonts.

We recommend one of the professional layouts from among our field-tested resume templates. These provide a structured, but personalizable design to start with. While we can’t do the heavy lifting of crafting your private equity resume, we can remove the obstacle of formatting to help you get your resume to market faster.

Private equity text-only resume example

Profile

Ambitious and analytical finance professional with an MBA and 5+ years of experience in investment banking seeking a private equity associate position at Blackstone to contribute to the firm's investment strategies, perform due diligence, and drive value creation for portfolio companies.

Employment history

Investment Banking Associate at Goldman Sachs, New York City

July 2020 - Present

- Conduct financial analysis and modeling for M&A transactions and capital markets offerings in the technology and healthcare sectors

- Perform due diligence on potential acquisition targets and assess strategic fit and valuation

- Prepare marketing materials and presentations for client pitches and deal execution

Investment Banking Analyst at Morgan Stanley, New York City

June 2015 - June 2018

- Supported senior bankers in the execution of M&A transactions, leveraged buyouts, and equity and debt offerings

- Developed financial models to analyze company performance, valuation, and pro forma capitalization

- Conducted industry research and prepared market update presentations for internal and external stakeholders

Skills

- Financial modeling and valuation

- Due diligence and transaction execution

- Industry research and analysis

- Presentation and communication

- Leadership and teamwork

Education

Master of Business Administration (MBA), Stern School of Business, New York City

August 2018 - May 2020

- GPA: 3.8/4.0

Bachelor of Science in Economics, The Wharton School, Philadelphia

August 2011 - May 2015

- GPA: 3.7/4.0

Private equity job market and outlook

Competition in the private equity job market is stiff, but that’s because it’s a dynamic and potentially lucrative career. Most start out with at least two years of other finance or investment banking experience.

Smaller firms may be your best bet as large firms took a hit in 2023 and have not fully recovered.

- Two of three private equity investors expected deal activity to increase through the first half of 2024.

- Energy infrastructure is a growing investment segment for private equity firms.

- There are almost 3,000 open private equity jobs.

What type of salary you can expect in private equity

Private equity analysts can expect salaries ranging from $100,000-$150,000. Associates earn between $150,000-$200,000, while at the highest level, managing directors or partners can earn anywhere from $700,00 to $2M.

Key takeaways for building a private equity resume

Private equity can be a lucrative career for someone with excellent financial analysis and negotiation skills. The complete skills package includes a talent for networking and building relationships. Combine these elements into a dynamic private equity resume targeted to each employer’s needs.

Our online resume builder can help you profit more quickly by streamlining the layout and design process.

.jpg)

.jpg)